Maximize Your Benefits: How to Use Your Long Term Care Insurance for Home Care Services in Houston

Looking to learn how to use your long term care insurance for home care services in Houston? This guide covers what you need to know: understanding your policy, navigating the claims process, and selecting the right home care providers.

Key Takeaways

Long-term care insurance is essential for covering a range of services, and understanding policy details is critical for effective utilization, especially concerning home care.

The claims process for long-term care insurance can be complex and time-consuming; thorough preparation of necessary documentation can expedite claims.

Planning for home care requires evaluating home care options that align with individual needs and managing both insurance and out-of-pocket expenses to ensure financial stability.

Understanding Your Long Term Care Insurance Policy

Long-term care insurance (LTC) serves as a crucial financial buffer, helping manage the often overwhelming costs associated with aging and care needs. These policies cover a wide array of services, including assistance with activities of daily living (ADLs) through in-home care, ensuring that those in need receive the appropriate level of care in their own home. Home care, defined as nonmedical assistance from a caregiver for ADLs, is essential for many seniors, allowing them to maintain their independence and quality of life.

Understanding the specifics of your long-term care insurance policy is paramount. The cost of long-term care insurance is influenced by policy features and individual care needs, which affect the benefit amounts. Most policies offer flexibility, allowing for more choices regarding the type and location of care, including home care, assisted living, and even nursing home care.

Hybrid policies, which combine long-term care benefits with life insurance or annuities, provide even greater flexibility in care choices. Being well-versed in the policy language and knowing what types of care are covered can make all the difference when it comes to effective use of your long-term care insurance.

Coverage Types

Long-term care insurance policies come in various forms, each designed to cover different aspects of long-term care services. Standalone long-term care insurance is specifically designed to cover a range of services, including home care, assisted living, and nursing facility care. Home health care, which includes medical care at home like skilled nursing and in-home therapy visits, is typically covered by long-term care insurance.

However, it’s crucial to consider what a long-term care insurance policy covers, as daily benefits may not cover the entire cost of in-home care, requiring additional financial planning. Some policies may also require caregivers to work for licensed providers, which can limit the use of family caregivers.

Home care agencies should offer a wide range of services to accommodate varying needs, from basic assistance to specialized medical care. Adding long-term care insurance riders to existing policies can provide additional coverage as needed.

Benefit Amounts

Benefit amounts in long-term care insurance can vary significantly based on the policy terms and chosen coverage. The level of benefits will depend on individual policy details, which include factors such as daily limits or total lifetime benefits. Understanding how these benefit amounts are structured and adjusted over time is crucial for planning your home care expenses effectively.

Inflation protection is often included in long-term care insurance policies to adjust benefits in accordance with rising care costs, ensuring that your coverage remains robust over time. By understanding the benefit amounts and how they evolve, you can better prepare for the financial aspects of home care and mitigate the burden on your family.

Navigating the Claims Process

Navigating the claims process for long-term care insurance can be a complex and time-consuming endeavor. Eligibility for initiating a claim typically includes meeting specific benefit requirements and receiving or planning to receive care. Processing a claim can take months or even longer, so it’s essential to be patient and thorough during this process. While a portion of home care or home health care may not be eligible for long-term care insurance benefits, knowing the ins and outs of your policy can help you maximize the coverage you do have.

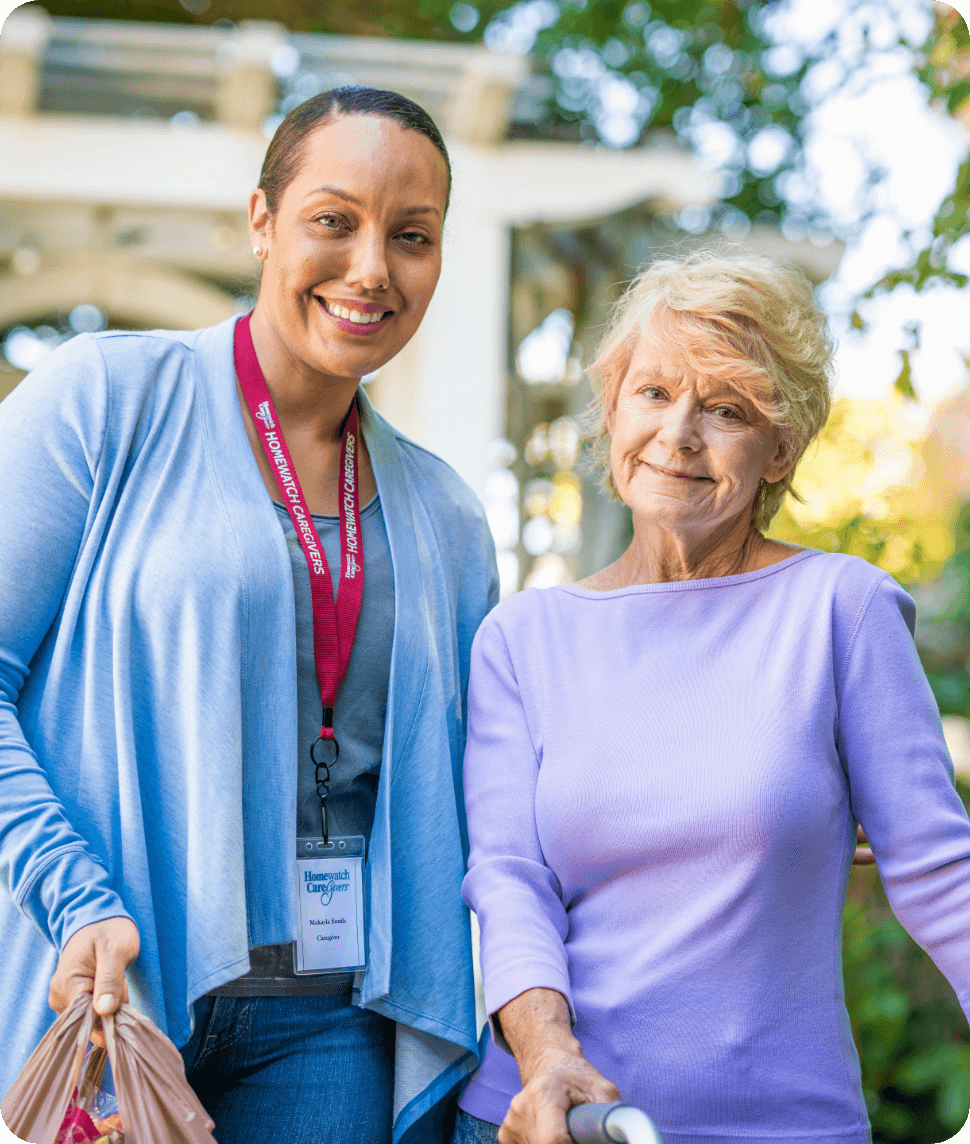

Homewatch CareGivers of Houston Galleria can assist with navigating the claims process, providing invaluable support to ensure you meet all necessary requirements. This assistance can significantly ease the burden on families, allowing them to focus on their loved one’s care rather than the complexities of insurance claims.

Preparing Documentation

Preparing the necessary documentation is a critical step in the claims process. Submitting a completed initial claim packet along with essential legal documentation, such as records and policy details, significantly aids the claims process.

Having all required documents in order can expedite the process and increase the chances of a successful claim.

Elimination Period

The elimination period in long-term care insurance is the timeframe during which policyholders are responsible for paying for their medical costs after a benefit is triggered. This period can last anywhere from 20 to 180 days, depending on the policy. During this period, the insured must cover care costs before insurance benefits activate, which can be a considerable financial burden.

Choosing the Right Home Care Services

Choosing the right home care services is essential to ensure that your loved one receives the best possible care in their own home. A long-term care insurance policy can empower families to select from a variety of home care options that suit their needs and preferences. When selecting care services, it’s crucial to consider the specific needs of the individual, ensuring compatibility with their long-term care insurance. Effective care planning can significantly enhance the quality and availability of home care services.

Personalizing the care experience by matching the caregiver to your loved one’s personality and preferences can make a significant difference in the quality of care received. Ensuring that the chosen services align with the individual’s needs and circumstances will help in providing consistent, high-quality care.

Evaluating Providers

Evaluating home care providers begins with understanding the importance of high-quality care. High-quality home care providers often offer specialized training for caregivers to address specific health conditions, including Alzheimer's disease, ensuring that the care provided meets the unique needs of each individual. Inquiring about the training and experience of caregivers, particularly in specialized areas relevant to the client’s needs, is essential.

Personalized services tailored to individual needs can significantly enhance the overall specialized care experience. Evaluating providers requires a thorough understanding of their quality of care, specialization, and ability to personalize services to meet the specific needs of the individual.

Matching Services to Needs

Matching the services to the individual’s needs is a crucial step in ensuring effective care. Care services should be tailored to accommodate various needs, including assistance with daily living activities and support for cognitive impairment. Identifying the specific daily living activities that the individual struggles with, such as dressing or bathing, is essential to ensure the right services are provided.

Home care experts provide continuous support, adjusting care plans as individual needs and circumstances change. This ongoing support is vital for adapting care strategies as clients’ health conditions evolve over time.

Alternative Payment Options

When family members do not qualify for Medicaid or other assistance programs based on financials, exploring additional payment options becomes crucial. Long-term care insurance can protect assets while helping to cover care costs, but it’s essential to understand the role of other payment options like Medicare and Medicaid, as well as the potential for out-of-pocket expenses.

Effective care planning can significantly mitigate the financial burden associated with long-term care. Considering all available payment options ensures that you can provide the necessary care without undue financial strain.

Medicare and Medicaid

Medicare offers limited home care benefits, primarily for skilled services under strict conditions. While Medicare provides coverage for certain services, these are often insufficient for comprehensive long-term care needs.

Medicaid, on the other hand, can cover a range of home care services for eligible individuals, potentially filling gaps left by private insurance. Continued support from home care professionals is vital for adapting to evolving care requirements and managing insurance complexities.

Understanding the interplay between Medicare, Medicaid, and long-term care insurance can help families navigate the financial aspects of home care more effectively.

Out-of-Pocket Expenses

Out-of-pocket expenses refer to costs incurred by the individual or their family that are not reimbursed by insurance policies, particularly in long-term care services. Common out-of-pocket expenses may include costs for personal care aids, medical supplies not covered by insurance, or home modifications necessary for safety and accessibility.

Planning for out-of-pocket expenses is crucial as long-term care needs may increase in complexity and cost over time, leading to significant financial strain if not anticipated. Strategies to manage future care costs include setting aside savings specifically for medical and care expenses and exploring alternative funding sources such as reverse mortgages or life insurance policies.

Working with a Home Care Expert

Working with a home care expert can make a significant difference in developing a comprehensive long-term care plan. Licensed experts help individuals plan and purchase insurance products, increasing efficacy in utilizing long-term care insurance. Consulting Homewatch CareGivers of Houston Galleria offers compassionate care, easing family anxiety.

After consulting with a home care expert, there are no obligations, making it easy for families to seek help and explore their options. This flexibility ensures that families can make informed decisions without feeling pressured.

Personalized Consultation

Tailored consultations can ensure that in home care services meet the specific needs and preferences of individuals. Flexible scheduling options are important for home care services, allowing adaptations based on changing circumstances without financial penalties.

Personalized consultations aim to create customized home care plans that align with each individual’s unique preferences and requirements. By addressing specific needs, these consultations help create a care plan that offers the best possible outcomes for the individual receiving care.

Ongoing Support

Ongoing support from home care experts is essential for navigating the challenges that come with changes in care needs and insurance coverage. This continuous support not only manages immediate needs but also prepares for prolonged or changing conditions concerning insurance coverage.

Having a long-term care insurance policy in place can alleviate anxiety related to potential care expenses down the line. This support adapts care plans to reflect changes in health status or needs, ensuring appropriate use of insurance coverage.

Planning for Future Care

Planning for future care is crucial for ensuring that individuals have access to necessary services over time. Effective long-term care planning prepares individuals for potential future care needs and associated costs. Consulting home care experts can significantly reduce the stress associated with long-term care planning.

Engaging with a home care expert can significantly enhance the quality of care for individuals needing assistance. This proactive approach helps families manage care needs effectively, ensuring that loved ones receive the best possible care.

Asset Preservation

Preserving assets is crucial when utilizing long-term care insurance to ensure financial stability and access to necessary services. Transferring assets into an irrevocable trust can protect them from being counted towards nursing home expenses.

Long-term care insurance helps protect personal assets while ensuring access to necessary ltc insurance services.

Peace of Mind

Long-term care insurance offers peace of mind knowing that care needs will be met without financial strain. Long-term care insurance mitigates the financial burden typically associated with home care services. This assurance allows families to focus on what truly matters: providing quality care and support for their loved ones.

The insurance policy is designed to cover various aspects of long-term care, ensuring that individuals receive the necessary support as they age. Overall, having long-term care insurance provides peace of mind, knowing that both care needs and financial concerns are effectively managed.

This sense of security is invaluable, especially when planning for the future.

Summary

In summary, understanding and effectively utilizing long-term care insurance can significantly enhance the quality of care for your loved ones while protecting your financial stability. By comprehending the specifics of your policy, navigating the claims process, and selecting the right home care services, you can ensure that your loved ones receive the best possible care. Exploring alternative payment options and working with home care experts can further alleviate the stress associated with long-term care planning.

Ultimately, planning for future care is about ensuring peace of mind and quality care for your loved ones. By taking proactive steps and seeking the right support, you can navigate the complexities of long-term care insurance and provide a secure, caring environment for those who matter most.

Frequently Asked Questions

What types of services are covered by long-term care insurance?

Long-term care insurance primarily covers home care, assisted living, and nursing facility care, along with support for activities of daily living (ADLs) such as bathing, dressing, and eating. This comprehensive coverage ensures that individuals receive necessary assistance as they age or face health challenges.

How do I initiate a claim for long-term care insurance?

To initiate a claim for long-term care insurance, you must meet the benefit requirements and submit a completed initial claim packet, including necessary documentation like medical records and your policy details. Ensuring all information is accurate and complete will facilitate the process.

What is an elimination period in long-term care insurance?

The elimination period in long-term care insurance refers to the duration during which policyholders must cover their own medical expenses after a claim is activated, typically lasting between 20 to 180 days. Understanding this period is crucial for financial planning and ensuring proper coverage.

How can I manage out-of-pocket expenses for long-term care?

To effectively manage out-of-pocket expenses for long-term care, prioritize setting aside savings and explore various funding sources to cover costs for personal care aides, medical supplies, and necessary home modifications. This proactive approach will help mitigate financial strain in the future.

Does traditional health insurance cover home care like Long-Term Care Insurance (LTCI) does?

No, traditional health insurance covers only short-term medical needs, while LTCI pays for ongoing home care, including help with daily activities like bathing and dressing.

CareGivers

Providing the highest quality of care at an affordable cost. Our local caregivers are trained, background-checked, and insured. This is our promise to you.

About Our Caregivers

Homewatch CareGivers is Here to Help.

[1].2502200935489.png)